Due to the rapid emergence and growth of digital currencies, the number of people trading has increased significantly. Due to their potential to serve the financial industry, many individuals and businesses are starting their own cryptocurrency exchanges. This discussion is about white label exchange. There are many people who are willing to start their own exchange.

One of the most important factors that investors consider when it comes to investing in cryptocurrencies is their ability to protect their assets. Due to the constantly evolving nature of the internet and the threats that are constantly threatening the security of their transactions, every major cryptocurrency exchange has strict policies and procedures in place to ensure that their users are protected. They also regularly update their platforms to keep up with the latest trends in technology.

Aside from being safe and fast, cryptocurrencies also have a significant advantage over other forms of financial transactions. They can be used as a vehicle for investors to gain capital gains. One of the most important factors that investors consider when it comes to investing in cryptocurrencies is their ability to store value.

In this article we will explain the main points of cryptocurrency exchange software development and provide a list of best white label cryptocurrency exchange software.

Main cryptocurrencies

Bitcoin

Bitcoin is the world's first and most popular virtual currency. It uses a blockchain technology to carry out secure and transparent transactions. Unlike other cryptocurrencies, it does not have a real value. The law of supply and demand dictates its price. In November 2021, when bitcoin hit its highest level and reached $68 000, it lost almost 30% of its value in just one month.

Since it is easier to handle transactions with third-party providers, it is recommended to use them instead of traditional banks. Some of the most prominent firms that provide these services include Binance, FTX, and Kucoin. Their goal is to protect their users from price reversals and ensure that they have the necessary flexibility.

Ethereum

Unlike Bitcoin, Ethereum uses a blockchain framework. It does not have a cap on the number of coins that can be created. This allows people to create unlimited coins. In addition, there are also smart contracts that are designed to allow users to perform various tasks. These programs collect data and codes that reside on the Ethereum blockchain.

To know more about Ethereum in comparison to other cryptocurrencies read in our related article:

USDT

In addition, a stable cryptocurrency like Ethereum can be used to prevent the price from fluctuating due to market factors. Unlike other cryptocurrencies, such as Bitcoin and Ethereum, the value of Tether does not change due to supply and demand. This ensures that it is an ideal alternative to the stock market. Also, since it is backed by US dollars, it is not as volatile as other cryptocurrencies.

FIAT currency

The future of cryptocurrencies is likely to be based on the issuance and control of fiat money. This type of currency is different from traditional money, such as cash. Because of this, virtual currency is less credible than the real thing.

Due to the nature of the trade, cryptocurrencies are more volatile than fiat currency. This is because investors tend to focus on making money by making profits. If the market is expecting that fiat money will continue to be used, then cryptocurrencies will not be replaced.

What is cryptocurrency exchange software?

A cryptocurrency exchange is a type of business that allows people to perform various types of transactions. It is commonly referred to as a place where individuals can trade stocks or other types of financial assets.

The goal of an exchange is to enable people to participate in a market where they can earn money by making a profit from the price variations that occur in the market. All of the digital assets are mined using free-market value.

A white label software package for cryptocurrency exchanges is usually designed to provide a set of features that can be easily rebranded. This type of package can also be used to enter the market and present a brand.

What problems does white label cryptocurrency exchange software solve?

Unlike other software packages, the white label software for cryptocurrency exchanges mainly focuses on multi-asset trading. This type of package allows investors to manage their multiple cryptocurrencies on a single platform. This eliminates the need for them to go to a separate wallet and store their multiple assets. Another advantage of using an exchange network is that it allows people to have a one-stop-shop for all of their financial assets.

So, one of the most important advantages of a white label software package for cryptocurrency exchanges is that it allows people to use their Bitcoin to purchase new altcoins.

Despite the various factors that affect the choice of a cryptocurrency exchange, most investors believe that it is very important that the industry is solved by having a proper and efficient exchange.

One of the most common reasons why people buy bonds and stocks is due to the high fees that are typically charged by financial intermediaries. However, with the emergence of digital coins, the role of brokers has been greatly reduced.

Aspects of developing a white label cryptocurrency exchange

Let’s talk about how to create a white label solution for a cryptocurrency exchange. We will also talk about the various steps that you should take to get started.

1. Choosing between two white label solution

There are two ways – white label license and white label solution.

A white label software license is a type of business license that provides a ready-to-go solution for a particular business operation. It can be either a hardware or software component that's delivered to its customers unbranded. So, you can buy ready-made software with a license.

White label software is a type of software that is delivered to customers without a brand name. It is designed to help users perform their operations more efficiently and effectively. It can be used by people who already have a functional business concept or have a specific set of requirements.

2. Finding niche and target audience

Before you start working with a technology partner, make sure that you have a clear understanding of the kind of business that you're planning on operating. This will allow you to make informed decisions regarding the development of the software framework.

One of the most critical factors that you should consider is the availability of liquidity and security. Having the necessary technical capabilities to create a white label exchange will allow you to reach the most potential customers. In addition to the security and liquidity of the exchange, other factors such as the need for a robust trading environment and the volume of transactions are also taken into account.

To ensure that your white label exchange is able to reach its full potential, you should create a platform that has the necessary features and functionality to meet the needs of its customers.

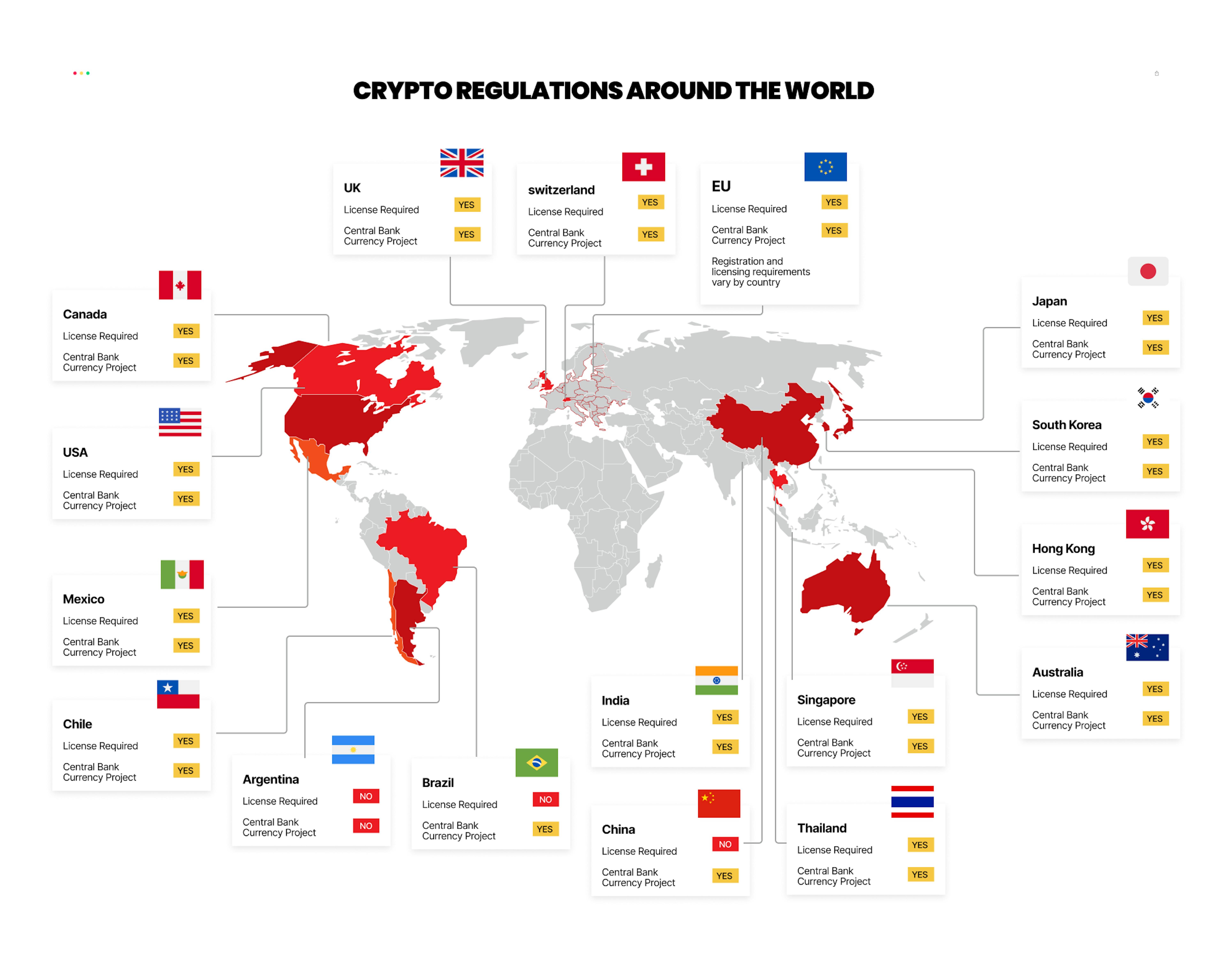

3. Choosing the regulation

The regulation of the financial industry is very important to ensure that you're able to operate successfully. It affects various aspects of the business, such as the taxation and business models that you can offer your customers. For instance, countries have banned cryptocurrencies, so you can't offer clients from China the opportunity to trade Bitcoin.

The laws regarding cryptocurrencies and exchange transactions vary significantly depending on the country and the regulator in place. Due to the rapid development of the industry, it's important to regularly monitor the release of legal documents related to this subject.

Here, you can find a list of crypto regulations around the world:

4. The liquidity management process

One of the first steps that you should consider when it comes to establishing a white label cryptocurrency platform is how liquidity will be provided. This is the ability for users to buy and sell assets at advantageous prices. Having the right amount of liquidity will allow them to execute their orders faster.

One of the most common ways to establish a white label cryptocurrency platform is through a prime of prime arrangement. This involves working with an external vendor that provides Tier 1 liquidity.

A non-bank liquidity provider method is known as a NBLP. This type of arrangement allows a cryptocurrency exchange to provide its users with the prices that are collected by various liquidity providers. Unlike with a Tier 1 vendor, this method does not require the exchange to pay commissions.

5. KYC and AML protocols

Before you can start a white label cryptocurrency exchange, you need to make sure that it is safe to operate. This can be done through the establishment of a business that compiles the necessary procedures.

KYC (Know Your Client) - Every person who wants to trade on a cryptocurrency exchange has to be verified to ensure that they are of legal age. This process can also help keep track of potential fraudsters and hackers.

KYT (Know Your Transaction) - The process involves checking the sources of funds and transactions that a user makes on a cryptocurrency exchange. It can also block funds and block transactions if the sources are considered suspicious.

AML (Anti-Money Laundering) - In most countries, cryptocurrency exchanges are required to follow certain rules when it comes to regulating and preventing money laundering and terrorist financing. For example, in the US, an exchange must have a dedicated anti-money laundering officer on its staff.

6. Finding the vendor

At the moment when you have a clear business concept, it’s time to find a potential partner. Make sure that you thoroughly check their background and provide them with all the necessary information. Also, make sure that the technology provider you choose fits seamlessly with your business's needs. Besides conducting a thorough background check, you should also ask them about their technical capabilities.

But this is only one side of the coin, there are more features inside the exchanger. When looking for the best crypto trading platform, keep an eye out for the following features.

Top cryptocurrency exchange software features

Customizable rates

Despite the overall value of digital coins being influenced by the market, individuals can still set their own prices. This is the reason why the world of cryptocurrencies is still evolving at the speed of light. Unlike traditional methods of exchange, the prices of cryptocurrencies will not be fixed.

Easy registration

When it comes to building a regular portfolio, one should thoroughly go through a verification process that will involve various checks and requirements. Some of these include a background check on the buyer's credit history, as well as their previous tax returns.

Online platforms make the process of establishing an account incredibly simple, as people need a reliable e-mail address and a secure payment method. With these types of platforms, investors can start investing immediately.

User support

Unlike other online businesses, online firms tend to provide better customer service than their counterparts in other sectors. This is because, unlike other businesses, they focus on interacting with their potential customers through their website.

This is because, unlike other businesses, online firms tend to provide better customer service than their counterparts in other sectors. They can also cut down on their operational costs by having an outsourced customer service department.

With cryptocurrency exchanges, the automated processes have helped achieve a brand new level of accessibility. In translation, the development of things like the crypto trading bot, algorithm-selected frequently asked questions, and live representatives with formidable knowledge about the market make it easy to get help.

The development of automated processes has helped improve the accessibility of cryptocurrency exchanges. In addition to the various features that have been built into their platforms, such as the trading bot, live representatives have also been able to provide a wide range of knowledge about the market.

Multi-platform accessibility

Due to the rise of technology, people are more likely to rely on their devices for every aspect of their lives. This means that an exchange should be able to be easily accessible on different platforms. For instance, if a host provides a website and a cryptocurrency trading app, then this type of business should be considered a cryptocurrency exchange.

Fortunately, there are a wide variety of software alternatives that can be used to exchange digital coins. These include platforms that are designed for different devices such as tablets and computers.

Things that are important to know

One of the first things that people should avoid when it comes to choosing an exchange is one that offers far-fetched guarantees. This can include websites that claim to have high returns within days or systems that promise to increase one's assets by several hundred times. These types of exchanges should not be considered promising ventures.

Unlike other businesses, cryptocurrency exchanges are not only focused on facilitating blockchain transactions. They also don't make any promises that are outlandish. People should also avoid offering mind-blowing earnings through strategies such as margin trading and borderline-belligerent short sales.

One of the most important factors that people should consider when it comes to choosing an exchange is its transparency. Since most of the platforms that are used to exchange digital coins use open-source code, people can easily inspect the operations of the system. This means that investors should be very skeptical if the software that they choose does not meet this standard.

Is it possible to determine which platform will be the most advantageous? There are various factors that can be considered when it comes to choosing a platform. For instance, if the user's preference is for a particular platform, then that could be the worst-case scenario for an investor. One of the most vital steps that a person should consider when it comes to making a selection is to analyze the various leaders in the market.

Let’s check the market and mark down the best white label cryptocurrency exchange software.

Top 10 cryptocurrency exchange software list

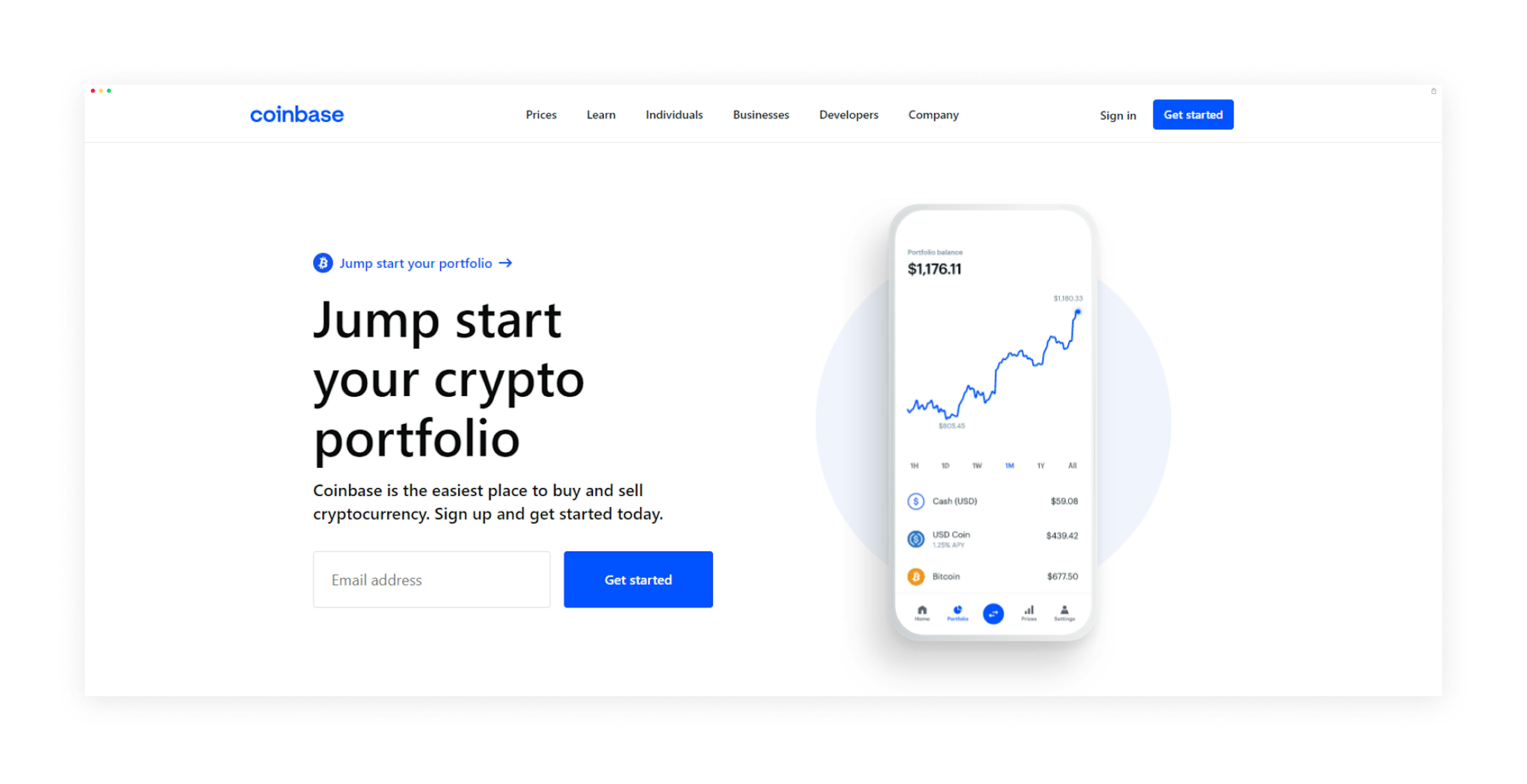

Coinbase Pro

One of best choice for both beginner and professional traders when it comes to choosing a crypto exchange. It has a wide variety of supported cryptocurrencies and is also equipped with an advanced trading platform called Coinbase Pro. This makes it a great option for both experienced and beginner traders.

It has a wide variety of supported cryptocurrencies and is also equipped with an advanced trading platform called Coinbase Pro. You can currently purchase various types of coins and tokens such as Bitcoin, Ethereum, and Litecoin. It also allows users to earn interest and participate in various activities.

Features:

Market: With Coinbase Pro, users can easily build a diverse cryptocurrency portfolio. With a variety of portfolios, investors can remain confident that their investments are protected even if the market crashes.

Order books: Feature of Coinbase Pro helps users establish a plan-of-action and keep track of their investments. It can also create a list of assets that they are interested in buying.

Market data: With a comprehensive market data toolkit, users can easily make informed decisions and monitor the performance of their assets. This tool provides users with the necessary tools to analyze and visualize their data.

Insurance backed: Unlike other financial instruments, cryptocurrency is insurance backed. This type of protection allows investors to recover their money if it's lost or stolen.

The API support: Allows users to customize the product according to their needs. This allows them to get a personalized experience when it comes to crypto trading. It also unlocks the backend code of the program so that they can easily configure it to meet their specific business needs.

Trading fees: the fee is between $0.99 and $2.99 depending on the dollar value.

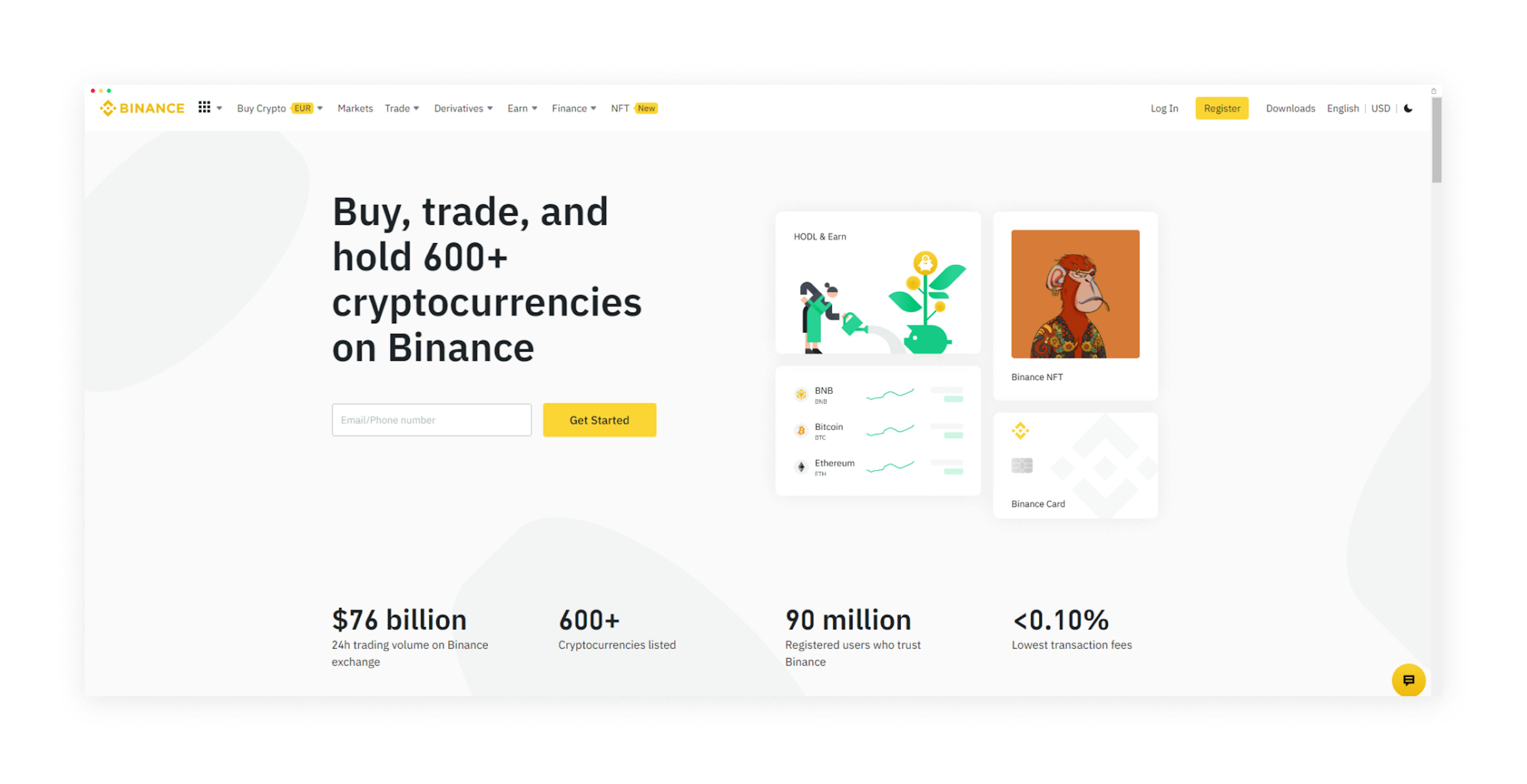

Binance

Binance is a software that makes it easy for people to start a cryptocurrency exchange portfolio. It allows users to trade a wide variety of cryptocurrencies and peer-to- peer transactions. It also has a support team that's available to help you whenever you need it. This is available for download on various platforms, including Mac, Linux, and Android devices.

Features:

Trade coins: Through this service, you can easily trade various currencies on the exchange. It also allows you to convert one of your coins into another. You can also do business with other users through its P2P trading capabilities.

Community: users at Binance is constantly discussing the latest trends and techniques in the cryptocurrency industry. They can help you improve the product by giving you advice and guidance directly from the people who are involved in it.

Support: The support team of Binance is available 24 hours a day to help you resolve any issues that you might have with the software.

API: allows users to customize the service by allowing them to create and implement various features and functions. These include integrations with other applications.

Blog: comprehensive source of news about the cryptocurrency industry. It features a variety of articles and updates about the latest trends and developments in the industry.

Trading Fees: The charges for different VIP categories vary depending on the type of trading activity. The maker fee is usually between 0.075 and 0.0525 for 30-day trading volumes of below 50 BTC and above 1500 BTC. The taker fee is usually between 0.125 and 0.145 for 30-day trading volumes of above 1500 BTC.

Kraken

One of the most popular platforms for crypto trading is the Kraken. They have a good selection of both cryptocurrencies and tokens, as well as a variety of margin trading. The Kraken Pro is a professional-grade platform that offers the lowest fees in the industry. It's also a great choice for experienced traders.

Features:

Trade coins: Besides being one of the biggest exchanges in the world, Kraken also has a wide selection of cryptocurrencies. It's a step up from other platforms that only offer a few well-known coins. Its high liquidity also helps it be easier to buy and sell.

Security: It's also one of the most secure platforms in the world. According to experts, it has maintained its reputation for being able to remain secure since it was first established nine years ago. Besides being able to provide a variety of security measures, the exchange also encourages its users to adopt healthy habits.

Market: Besides being able to provide a variety of security measures, it also encourages its users to adopt healthy habits. One of the most prominent platforms that allows high-volume investors to trade anonymously is Kraken. It has a dark pool that allows its users to trade without being detected.

Trading fees: The maker fee for the exchange is usually between 0.16% and 0.10% for 30-day trading volumes of $0 to $500,000. The taker fee, on the other hand, is usually between 0.26% and 0.20% for the same amount.

Gemini

This is a cryptocurrency exchange that offers a variety of assets for sale and trade. It also has a strong security and compliance framework. Besides being able to trade and buy multiple types of cryptocurrencies, the platform also provides users with a variety of services and products. Some of these include a credit card and a built-in hot wallet.

Aside from being able to trade and buy multiple types of cryptocurrencies, the platform also provides users with a variety of services and products. Its support page is very helpful for newcomers. Also, its ActiveTrader platform allows experienced traders to perform various trades quickly.

Features:

Trade coins: Gemini offers more than 50 cryptocurrencies. Users who don't have a cryptocurrency wallet can also benefit from the exchange's free digital asset insurance. This type of insurance covers the losses that can be caused by various factors such as a security breach or unauthorized transfer.

Security: Gemini is equipped with industry-standard security features, such as two-factor authentication and wallet address whitelisting. To access its full trading features, users need to complete a government-issued photo ID verification process. This process can be done by uploading a photo ID. This process is designed to help minimize the risk of fraud on the platform. In addition to being able to provide its users with industry-standard security features, Gemini recently became SOC 2-certified, which shows the company's commitment to maintaining a secure environment.

Support: The platform also provides users with a variety of services and products. Its support center is additionally equipped with a virtual chatbot, which users can use to ask questions. Like other exchanges, Gemini does not provide live support.

Trading fees: The platform charges a flat fee for each transaction, as well as a small fee for auction participants and sellers - 0.250% fees for buyers, 0.100% fees for sellers, and 0.2% for auction participants for accounts having less than $1 million.

Cex.io

The platform is currently used by various organizations such as finance, education, and military services. As multiple users noted that it was very intuitive to use. It was also very popular among new users who are looking to trade cryptocurrencies.it allows users to buy and sell various types of cryptocurrencies. It also supports a wide variety of international currencies.

Features:

Price alerts: One of the most useful features of the platform, which allow users to get a quick and accurate price change. With just a few clicks, the system will buy coins at the appropriate price whenever the market drops.

Security: The platform is also very secure, as it takes various steps to ensure that your digital assets remain secure. It has strong data encryption that prevents unauthorized persons from accessing your information. It also keeps your coins in cold storage locations to prevent them from being stolen.

Earn/Stake: The program comes with a convenient feature, which allows users to earn and take advantage of its various benefits. It allows them to hold their stackable coins for an indefinite amount of time to maximize their return on investment.

Trading fees: The platform's trading fees are generally in line with the industry average - 0.25%. They also provide a discount to its makers - a fee of 0.15% , who are able to make transactions at a lower fee. This is beneficial for investors who are not interested in picking up new orders.

Bisq

Bisq is a mobile and desktop application that allows users to exchange their local currencies for Bitcoin. It works on a peer-to-peer basis, so users can send and receive payments directly from others.

In order to make a trade, users pay for it in Bitcoin. The fees are calculated based on the amount of money that they exchange. The maker or those who make transactions worth a certain amount of BTC pay 0.10% while the ones who take orders or buy pay 0.70%.

If a user has a government-issued ID, they can open a savings account. However, this is not necessary for those who are trading cryptocurrencies.

Features:

Security: Unlike other platforms, Bisq is not a centralized platform and does not have any assets, so it does not allow the use of hard or Bitcoin currencies. In order to ensure that the transaction goes smoothly, both parties must put down a security deposit. The platform also offers three different dispute resolution options, such as mediation, arbitration, and chat.

Functionality: As we said, Bisq is completely decentralized, so it does not require a traditional account to use. To use it, users just need to download the software and install it on their computer. Currently, it's available on various operating systems such as Windows, macOS, and Linux.

Trading fees: When using Bitcoin, the fees are equal to 1% of the total amount of money that's been exchanged. The seller will pay 0.12% of the fee, while the buyer will pay 0.88%. On the other hand, paying in BSQ will reduce the fees by around 50% because the community supports the project.

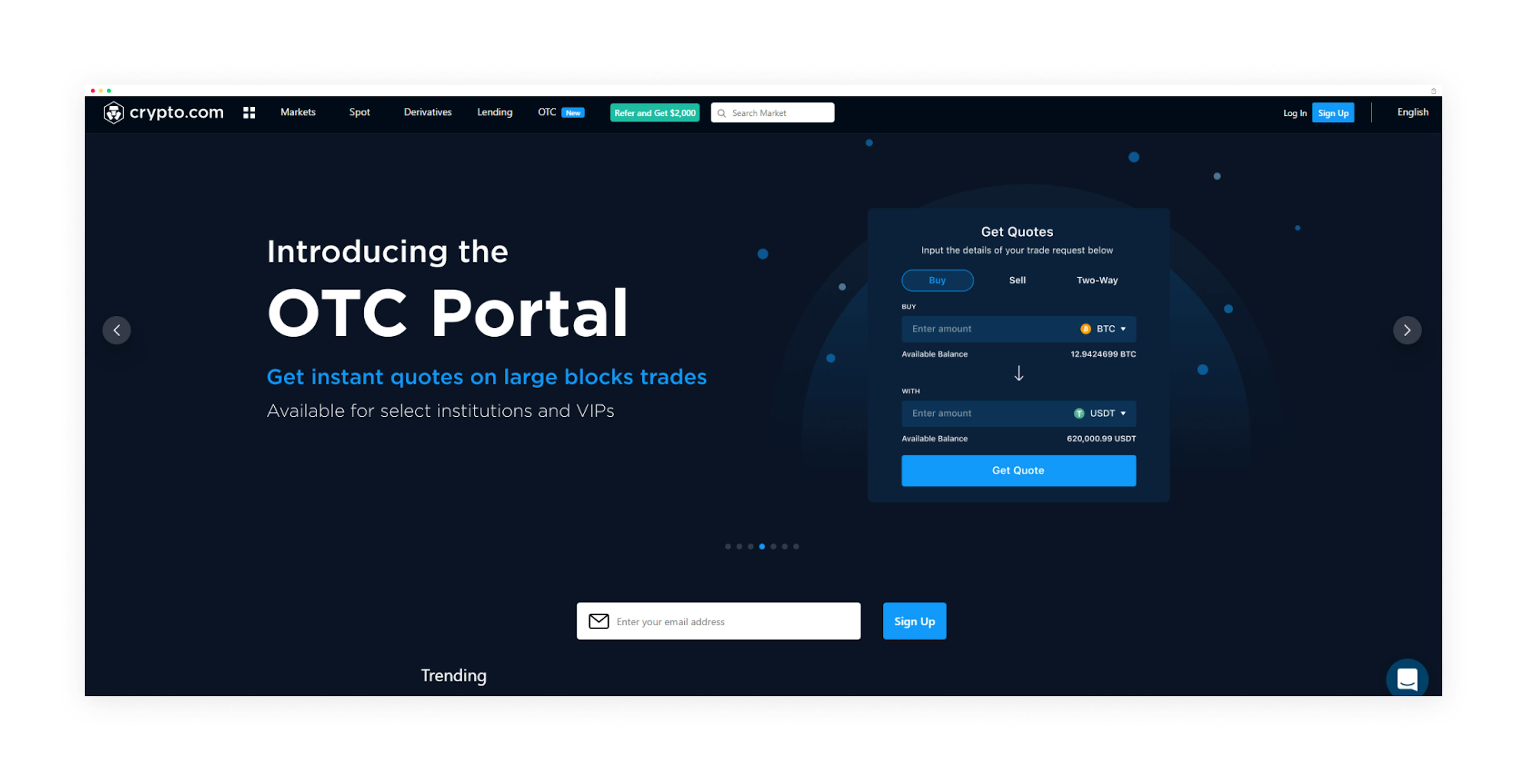

Crypto.com

With over 10 million global users and 3,000 employees, Crypto.com is a leading platform for people who are interested in learning more about cryptocurrencies. It offers a wide variety of educational tools and research to help you trade successfully.

Features:

Trade coin: Through the Crypto.com card, users can easily buy and manage 250 cryptocurrencies. The card allows them to access and spend their crypto at any time with Visa outlets globally.

Security: To protect its users' accounts, Crypto.com uses various measures such as multi-factor authentication and whitelisting. These are all designed to help keep the accounts secure. However, it's additionally important to remember that cryptocurrency transactions can't be reversed, so it's unlikely that you'll recover any lost money.

Support: Support is available through a variety of methods, such as live chat, email, and a help page. Unfortunately, some users report experiencing issues with the support system, and the lack of help resolving them.

Functionality: To create a new Crypto.com account, download the app from the Apple or Google Store. After entering your email and password, the app will automatically create a new account for you. Your new Crypto.com account will be verified using your name, photo ID, and a selfie.

Trading fees: From 0.4% for Level 1 to 0.04% for Level 9, the trading fee is calculated as the difference between the taker and maker fees.

Bittrex

One of the most popular platforms for trading cryptocurrencies is Bittrex, which lists the largest number of different types of coins that its users can trade. The exchange is considered secure and fast. Besides being considered secure and fast, Bittrex also offers low trading fees.

Features:

Trade coin: Bittrex is a global exchange that allows users to buy, sell, and trade 400 types cryptocurrencies. Its low fees and multiple order types make it an ideal choice for people who are looking to make their funds safe.

Functionality: The trading experience is fairly simple on Bittrex. Its users can log in to its desktop or mobile app to manage their accounts. The desktop interface provides a simple and straightforward way for them to make quick trades. They can also easily buy and sell cryptocurrencies with their bank account, debit card, or Bittrex balance.

Security: Bittrex has various security features that help protect its users' funds. It also has a variety of measures that can be used to prevent unauthorized access. Some of these include two-factor authentication, IP address blacklisting, and wallet and IP whitelisting. Besides these features, Bittrex also has a variety of security guidelines that can help users keep their accounts secure. These include avoiding phishing attempts and remembering strong passwords.

Support: Unfortunately, Bittrex doesn't have many options when it comes to providing customer support. This means that if a major issue occurs, its users will likely not be able to get immediate help. They can try to reach the company through its website or its chatbot, Trexie.

Trading fees: Bittrex charges a flat fee rate of 0.25% for all trades.

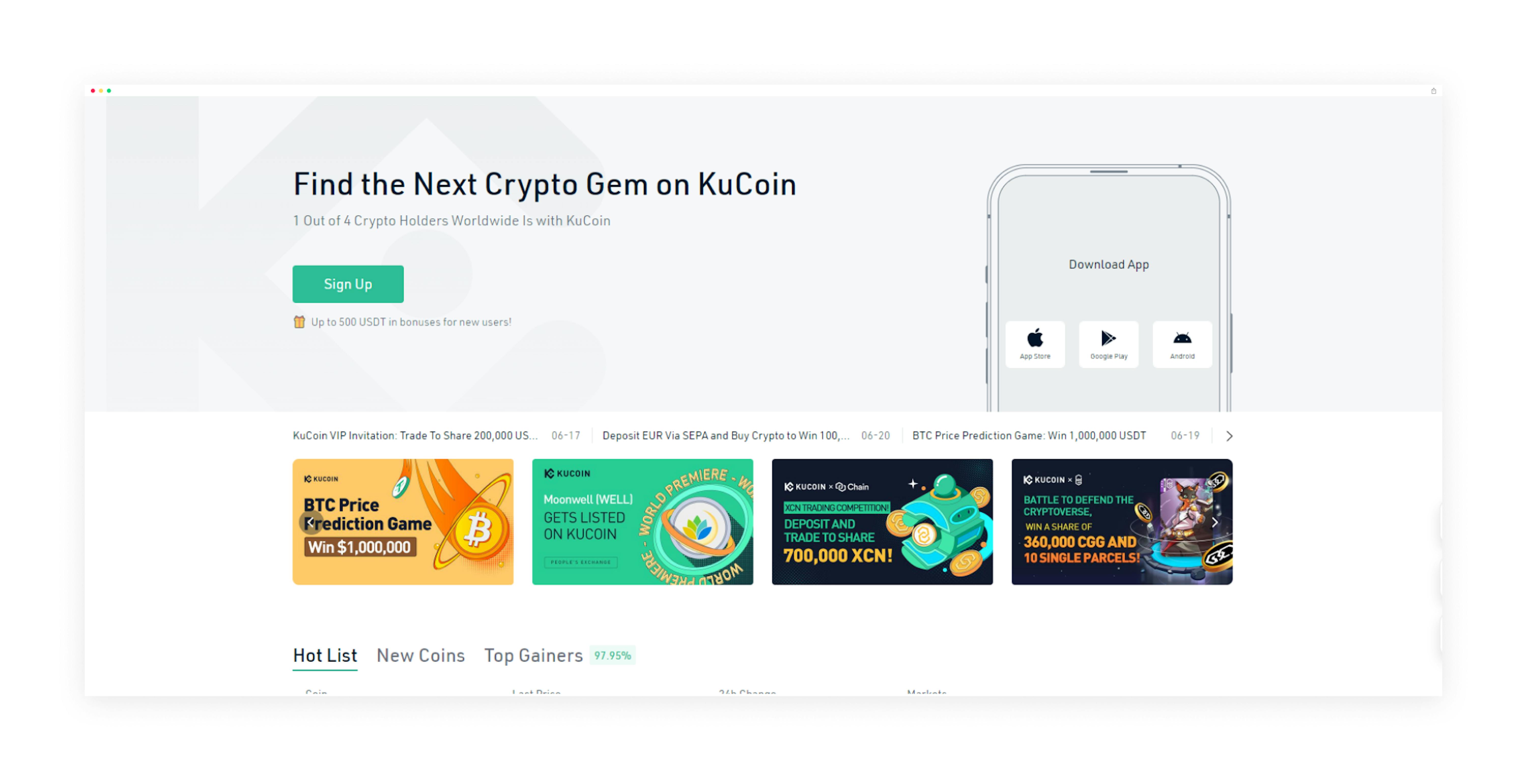

Kucoin

Kucoin is a high-functioning software product that allows users to easily trade a wide variety of cryptocurrencies. Its robust core trading engine and asset security management tools help keep its users' funds safe and secure. It also acts as a white label exchange, which allows it to continue adding new currencies.

Features:

Market: A core trading engine is a powerful tool that allows users to perform multiple transactions at the same time. With a white label exchange, Kucoin can also add new currencies to its existing list. This allows its users to easily diversify their portfolios.

Functionality: Kucoin's native currency, Kucoin Shares, is also known for its daily incentives. It comes with a lower trading and withdrawal fee than other currencies, and it can also provide users with exclusive promotions and rewards.

Liquidity: The robust liquidity rate of the well-funded market allows for fast transaction processing. Its active exchange also allows for total scalability, which means that it can handle the amount of trading that your organization can handle.

API: You can easily customize the system to meet the needs of your organization. This allows you to build applications that can help improve the efficiency of your organization. Its built-in features can also help you customize the backend code to meet your specific needs.

Security: Kucoin also takes the necessary steps to ensure that its users' investments are secure. Through its team of experts, the vendor can regularly review and close any security gaps that it discovers. These services can help protect your assets from cybercrimes and protect your employees from identity theft.

Trading fees: trading fees is ranging from 0.0125%-0.1%, depending on your tier level. Users can also get a trading fee discount based on their Kucoin Token balance.

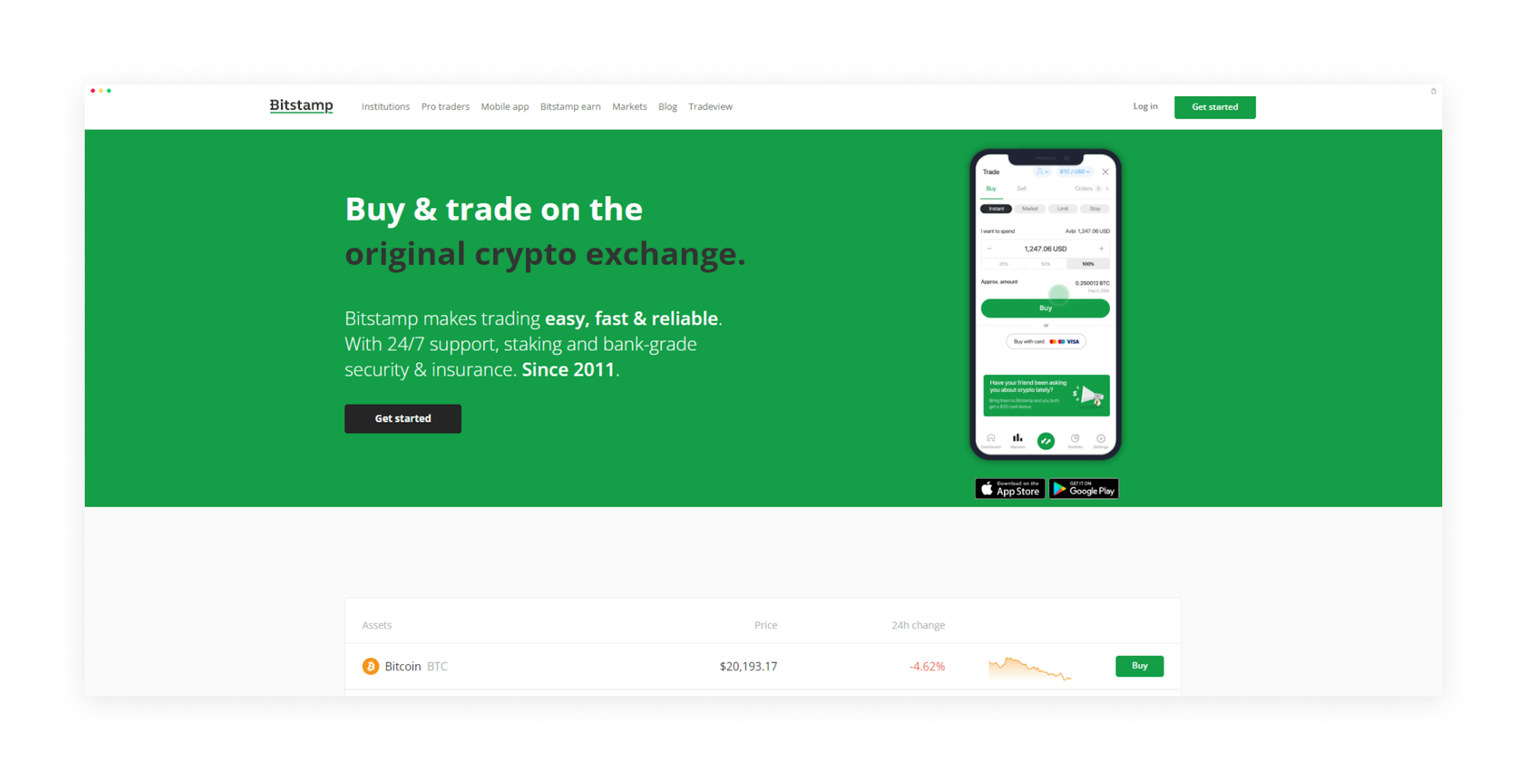

Bitstamp

Bitstamp is a leading exchange that's licensed to operate in the US and the EU. It's also one of the top three in the Euro and USD markets. Through its relationships with various banks, it can provide its customers with a variety of payment options. Despite the volatility of cryptocurrencies, Bitstamp is still able to keep its customers' accounts secure. It also provides a variety of fee models, which are designed to help its users get the most out of their trading.

Although it's an early player in the space, Bitstamp currently only supports a limited number of cryptocurrencies. Despite that, they are mainly enough for most traders.

Features:

Trade coin: Since it was first established, Bitstamp has been one of the oldest and most stable cryptocurrency exchanges in the world. It currently supports 54 cryptocurrencies and has competitive trading fees.

Security: Bitstamp uses strong security measures, such as multi-factor authentication, to keep its clients' funds secure. When signing up for an account, the platform allows users to set up and use multiple-factor authentication.

Functionality: After you enter your email address, you'll be prompted to set an account password and then connect to a multi-factor authentication app, such as Google Authenticator. This will allow you to keep your account secure. To meet the KYC requirements, you'll be prompted to upload a photo ID and a short video of yourself. After you submit your personal contact information and photos, your account will be reviewed.

Support: You can contact Bitstamp customer service via email or by calling The company also has an extensive help section that's designed to help its users navigate through the various features of its platform.

Trading fees: They are based on the monthly trade volume. They can be charged as low as 0.5% for those with less than $10,000 and as high as 0.25% for those with more than $20,000.

To wrap up

A cryptocurrency exchange is a type of financial institution that allows traders to buy and sell various types of cryptocurrencies. It's necessary for these assets to be traded at the current scale. Some of the exchanges offer the fastest trading speeds and competitive prices. Besides buying and selling cryptocurrencies, it can also be done in two different ways: either as a way to exchange one for another or as a way to make a profit. Most traders will rely on proven strategies and trading platforms to achieve their goals.

Before you start trading cryptocurrencies, it's important that you consider the various factors that affect the process of buying and selling them. In this list above, we provided the top 10 best cryptocurrency exchanges. Hope you will find the most suitable for you.